Abuja, Nigeria

This report provides the details of how Value Added Tax (VAT) was generated and shared among the thirty-six States of the country in 2024.

According to data from the Federal Account Allocation Committee (FAAC) and Agora Policy, each of the states contributed to the national VAT pool and received certain amounts in return as part of their monthly allocations.

This data as visualised by DailyAgent Analytics, provides insights for understanding the economic activities and VAT revenue distribution across different states in Nigeria in 2024.

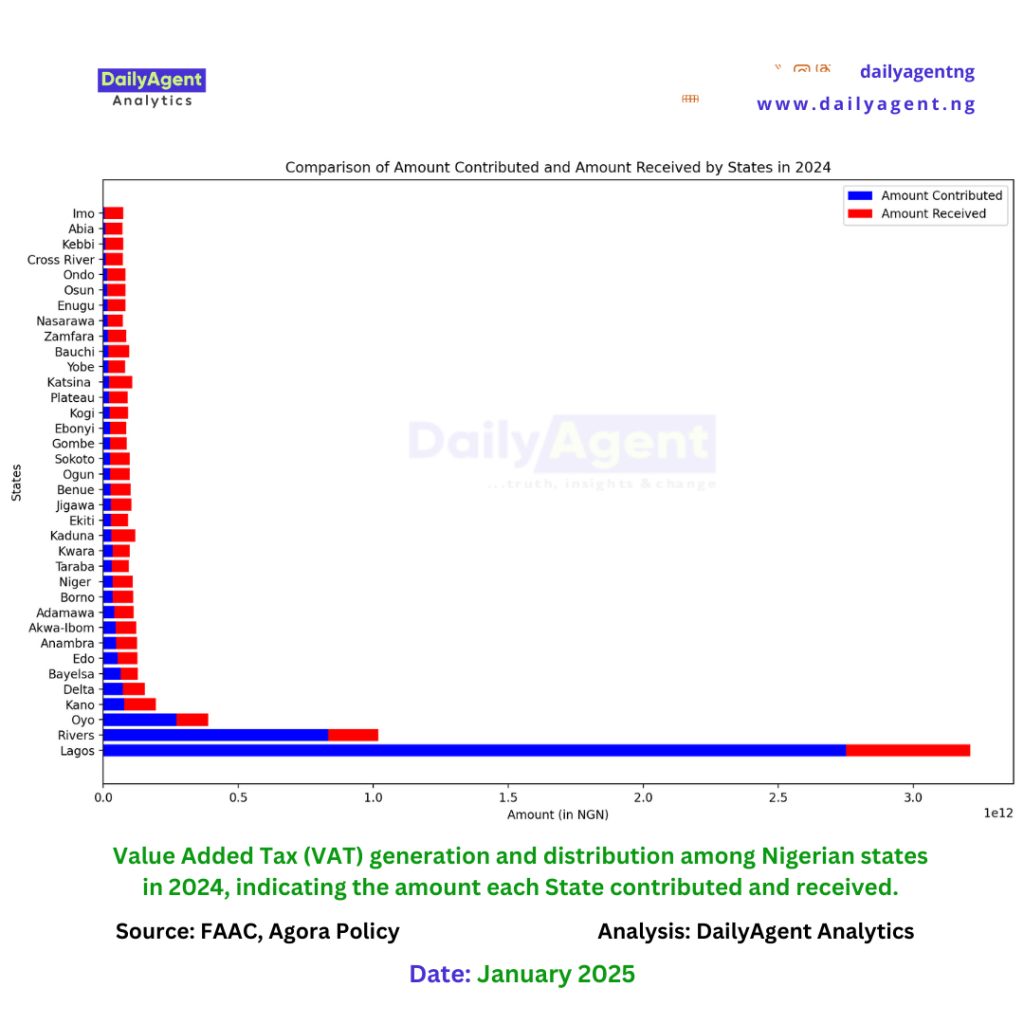

Overview of what States contributed and received from VAT in 2024

In our analysis, Lagos tops the list of contributors with N2.75 trillion but received a share of N460.11 billion followed by Rivers having contributed N832.96 billion but received N186.66 billion.

Oyo also contributed N272.41 billion but received N116.83 billion, while Kano contributed N77.76 billion but received N117.19 billion.

comparing the amounts contributed and received by each state in 2024. The chart visually represents the differences in VAT contributions and receipts, allowing for easy comparison across the states.

The bar chart effectively compares the amounts contributed and received by each Nigerian state in 2024. The blue bars represent the amounts contributed to the VAT pool, while the red bars indicate the amounts received from it. This visualization allows for a clear assessment of how each state contributes to and benefits from the VAT system.

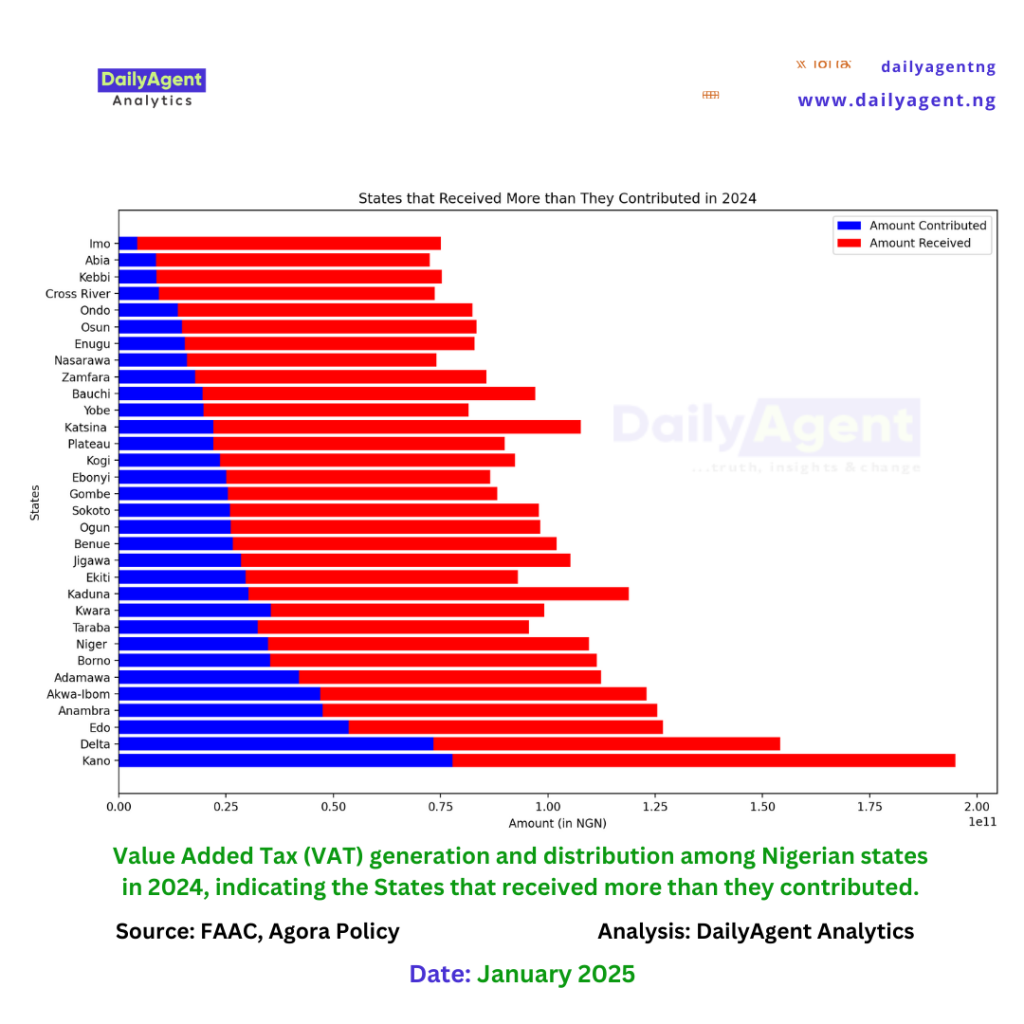

States that received more than what they contributed to the VAT pool in 2024

The analysis revealed some states that received more than they contributed to the VAT pool in 2024, justifying some of the arguments being pushed by some stakeholders in the ongoing tax reform bills conversation in the country.

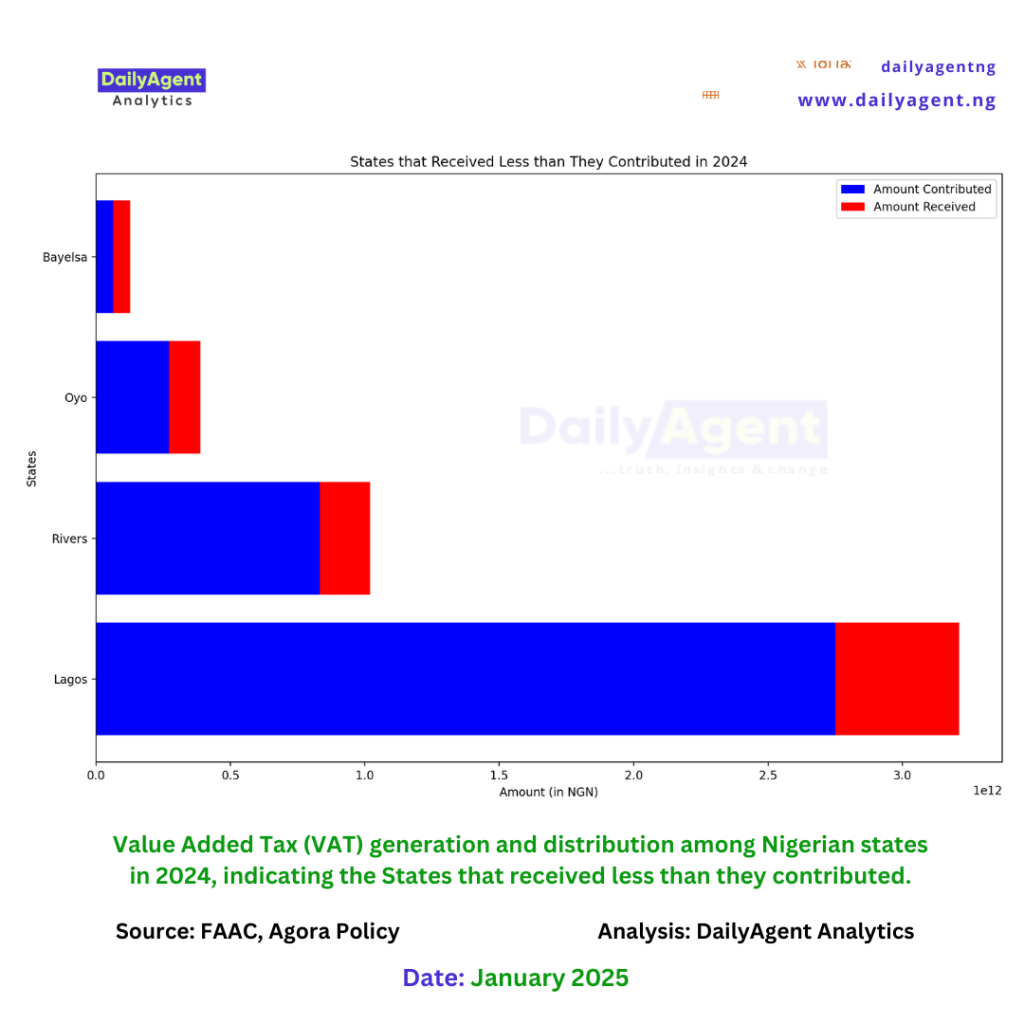

States that received less than what they contributed to the VAT pool in 2024

States like Lagos, Rivers, Oyo and Bayelsa got less allocation from VAT distribution than they contributed. These states received less than they contributed to the VAT pool in 2024.